History

Intesa Sanpaolo was created on January 1, 2007, through the merger of two leading Italian banking groups, Banca Intesa and Sanpaolo IMI.

The first steps toward the merger process were taken on August 26, 2006, when the Boards of Directors of the two banks approved the guidelines for a merger plan. The plan was then agreed by the Boards on October 12, 2006, and ratified by the Extraordinary Shareholders' Meetings of the two banks on December 1 of the same year.

Intesa Sanpaolo acquired control of UBI Banca on August 5, 2020 and merged it by incorporation on April 12, 2021.

Banca Intesa

Banca Intesa was formed in 1998 from the merger of Cariplo and Banco Ambrosiano Veneto. In 1999, Banca Commerciale Italiana (BCI) joined the Intesa Group. With the subsequent merger of BCI into Banca Intesa (May 2001), the group took the name IntesaBci. In December 2002 the Shareholders' Meeting resolved the change of the company name to Banca Intesa, effective as of January 1, 2003.

1998

January 1

Establishment of Banca Intesa

January 2

Purchase of Cariplo from Fondazione Cariplo

May 21

Definition of the Group's new federal organisation

June 1

Presentation of the industrial plan to the market

1999

June 8

Banca Intesa's Board of Directors authorised contacts with Banca Commerciale Italiana (BCI)

June 30

Banca Intesa's Board of Directors approved the integration of BCI according to the federal model

August 17

The Shareholders' Meeting approved the capital increase for the purchase of 70% of BCI

September 27 - October 15

Intesa-BCI Tender Offer

2000

April 11

Presentation of the new divisional model to the market

June 6

The integration of BCI began; Steering Committee and area managers appointed

July 28

Banca Intesa's Shareholders' Meeting approved the merger of Ambroveneto, Cariplo and Mediocredito Lombardo

October 10

The Boards of Directors approved the merger of Banca Commerciale Italiana

November 17

New Board of Directors of Banca Intesa appointed

December 19

The operating management of the Group appointed

December 31

Banca Intesa incorporated Ambroveneto, Cariplo and Mediocredito Lombardo

2001

February 28

BCI's Shareholders' Meeting approved the merger by incorporation into Banca Intesa

March 1

The Shareholders' Meeting of Banca Intesa approved the merger of BCI

March 26

Approval of the 2001-2003 Master Plan

April 24

The merger deed between Banca Intesa and BCI was signed

May 1

IntesaBci formed

2002

June 25

The Board of Directors approved the new organizational structure based on Divisions

September 9

The Board approved the 2003-2005 Business Plan

1December 17

The Extraordinary Shareholders' Meeting of IntesaBci resolved to change the company name to Banca Intesa Spa

San Paolo IMI

Sanpaolo IMI was formed in 1998 from the merger of Istituto Bancario San Paolo di Torino and IMI (Istituto Mobiliare Italiano). These two banks were highly complementary: Istituto Bancario San Paolo di Torino was specialised in retail lending, IMI, a public entity founded in 1931 to support the reconstruction of the national industrial system, was a leading business and investment bank.

1998

Merger of Istituto Bancario San Paolo di Torino (which has its roots in the Monte di Pietà founded in Turin in 1563), and IMI, and the renaming of the entity as Sanpaolo IMI.

2000

Sanpaolo IMI continued to grow nationally, acquiring Banco di Napoli (that was founded as long ago as 1539 as a charitable institution focussed on helping the needy), entering into the share capital of Cassa dei Risparmi di Forlì e della Romagna and setting up strategic alliances with leading Italian and foreign banking institutions.

2001 - 2002

Integration with the Cardine Group, established through the merger of the Casse Venete and Casse Emiliano Romagnole Groups and consisting of seven banks (Cassa di Risparmio in Bologna, Cassa di Risparmio di Venezia, Cassa di Risparmio di Udine e Pordenone, Cassa di Risparmio di Gorizia, Banca Popolare dell'Adriatico - renamed Banca dell'Adriatico - and Banca Agricola di Cerea), operating in northeastern Italy and along the Adriatic coast.

2003

Steps were taken to ensure the integration of Banco di Napoli and the Banks of the Cardine Group. To facilitate this integration process, companies operating within the same territory were combined: Banca Agricola di Cerea was therefore taken over by Cassa di Risparmio di Padova e Rovigo - renamed Cassa di Risparmio del Veneto - while Cassa di Risparmio di Udine e Pordenone and Cassa di Risparmio di Gorizia were merged to form Friulcassa, renamed Cassa di Risparmio del Friuli Venezia Giulia. In July 2003 the spin off of Sanpaolo Banco di Napoli, the major bank operating in southern Italy, was completed and in 2007 the bank took its original denomination Banco di Napoli.

2004

Integration of all of the Group's Commercial Banks, adopting the same organisational and business model and the same IT platform, was completed.

2005

The project for the new Insurance pole is launched and in October the strategic plan for the three-year period 2006-2008 is presented.

2006

In January, the second phase of the development of the Savings and Pensions pole, which envisages the integration of Asset Management (Eurizon Capital SGR) into Eurizon Financial Group already including the insurance company EurizonVita (formerly AIP) and Banca Fideuram, is approved. In 2007, Eurizon Financial Group will be merged into Intesa Sanpaolo. After this merger, the three companies under Eurizon Financial Group's control will report directly to Intesa Sanpaolo.

UBI Banca

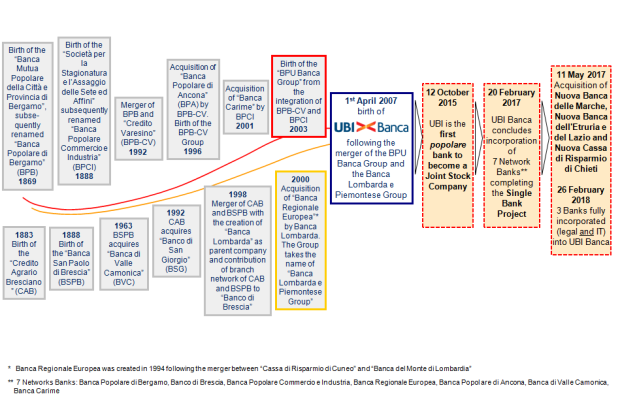

UBI Banca was formed on April 1, 2007 from the merger of the BPU Banca Group and the Banca Lombarda e Piemontese Group, which were established following a series of mergers.

Last updated 3 December 2021 at 17:48:09